Innovation with impact

Expleo innovation is aligned to

the UN Sustainable Development Goals to help industries build a smarter, safer and greener future for us all.

Scroll

Journey to S4HANA with confidence

We have the expertise to keep you on course, on time, and on budget, as you implement S/4HANA.

Scroll

Move at the speed of digital

Industrialise your digital innovations and drive immediate results.

Scroll

What's new

Business TransformationDigital TransformationEngineering and DesignMobility

Meet Expleo at Farnborough International Airshow

Data Science & CybersecurityCompliance & RegulationSustainability & Environment

8 Benefits of the MHHS Programme Roll Out for Utility Suppliers

Industry 4.0Business TransformationData Science & CybersecurityEngineering and Design

See visual inspection differently: How we used Artificial Intelligence to improve accuracy and reduce processing time for an automotive manufacturer

Artificial Intelligence & RoboticsQuality Assurance & Software Development

Redefining Modern Development: The Intersection of GenAI and DevSecOps

Artificial Intelligence & RoboticsBusiness TransformationCorporatePeople & Leadership

5 ways to boost developer productivity

In the final installment of this three-part blog series, I outline five clear steps companies can take to enhance developer productivity and establish their own framework for engineering excellence.

Artificial Intelligence & RoboticsQuality Assurance & Software Development

Can Generative AI plug the 4 million software developer gap?

CorporateBusiness TransformationCompliance & RegulationData Science & Cybersecurity

Expleo to exhibit at Collibra Data Citizens ’24

Expleo and McDonald’s Corporation will jointly present the strategy of building a Collibra data intelligence foundation in 60 days and extending it to support AI governance.

Digital TransformationData Science & CybersecurityQuality Assurance & Software Development

Embracing Agile Software Delivery to address the Developer Shortage

CorporatePeople & Leadership

Expleo continues expansion in Spain

Expleo opens fourth office in Spain to meet market needs for digital and engineering expertise

Data Science & CybersecurityCompliance & Regulation

Simplifying data analysis to enhance decision-making: how we helped automotive engineers make smarter, faster decisions.

Artificial Intelligence & RoboticsBusiness TransformationDigital TransformationIndustry 4.0

AI & Hyperautomation Summit 2024

Register for AI & Hyperautomation Summit 2024, to join live online or onsite at Dublin and build your organisation’s innovation strategy.

Innovation and R&DEngineering and DesignSustainability & Environment

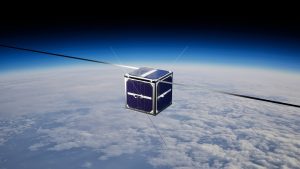

Expleo receives first signals from ENSO nanosatellite

Testing confirms nanosatellite is ‘healthy’ and ready to undertake its two-year mission.

Business TransformationCorporateDigital TransformationPeople & Leadership

Bridging the Digital Divide: The Power of the Digital Skills Factory

Business TransformationSustainability & Environment

Platform alteration: The challenge of adopting new systems for energy retailers

Business TransformationSustainability & Environment

Market-wide settlement reform – A moment of opportunity?

CorporateDigital Transformation

Expleo continues growth and profitability in 2023

Group achieves third year of growth and profitability as demand for engineering and digitalisation expertise remains strong

Artificial Intelligence & Robotics

How Generative AI can proactively address issues to enhance customer satisfaction

Sustainability & EnvironmentCorporate

Expleo receives EcoVadis Gold award for sustainability

Expleo ranked in the top 5% of assessed companies based on strength of sustainability and CSR practices

Corporate

Expleo wins Large Supplier of the Year in Hiscox Awards

Business TransformationDigital TransformationQuality Assurance & Software Development

Successful transition from Intershop to Salesforce Commerce Cloud for

The Creative Club

SERVICES

We fast-track your innovation through each step of your value chain

CAREERS

We are home to bold and reliable minds

They’re balanced forces – the yin and yang of business innovation – able to mutually thrive through smart teamwork In our company, “bold” and “reliable” play on the same team.

If you want to rise to the challenge …